Is it too much to ask for your home to take care of itself once in a while? To cover the costs of home repairs or remodeling on its own? Not really! There are loans available that let you use your home’s equity as collateral. Or, you can choose cash-out refinancing to get the money you need. In either case, you’re using an investment you’ve already made to finance the home improvements you dream of.

Making repairs or remodeling can help maintain your home’s value, increase its resale value, or just make it a more enjoyable place to live. The longer you plan to stay in your home, the more financial sense it makes, and the more likely you’ll be able to recover the costs. Below are descriptions of the financing options available to you.

If you’re interested in getting a loan to pay for home repairs or remodeling, you have a choice between a home equity loan and a home equity line of credit, or HELOC. Both of these are like getting a second mortgage, with your home being used as the collateral for the loan. This creates a lien against the house – if you don’t pay the loan back, the lender could foreclose on your home. Equity loans are generally a little harder to qualify for, requiring borrowers to have good or excellent credit, but they’re also faster and easier to obtain than a mortgage. They provide a specific amount of money based on the value of your property, which will be determined by an appraiser. They come with interest rates that are generally higher than a mortgage, but with no or lower costs and fees. The interest payments are usually tax deductible as well.*

If you choose a home equity loan you’ll receive a single lump sum of money at a fixed interest rate at a term usually shorter than a mortgage, 5-15 years. You’ll then make monthly payments for the life of the loan until you pay it back.

If you choose a HELOC you will not receive a single lump sum. You’ll qualify for a specific amount that is then available to you as a line of credit. So you use, or borrow, the money as you need it. You only pay interest and make payments on the money you use. HELOC interest rates tend to be slightly lower than an equity loan.

Keep in mind, if you choose either type of equity loan, you’ll have two monthly payments, for the loan and your mortgage, each with different interest rates.

Much like traditional refinancing, cash-out refinancing will likely give you a lower interest rate, lower monthly payments, perhaps even a shorter term. Each of which offers you different ways to save money. However, it also allows you to turn a portion of your home’s equity into cash. Getting the money to pay for home repairs or remodeling is one of the top reasons people use cash-out refinancing. It lets you avoid taking out a new, separate loan so you only have one affordable monthly payment at an interest rate probably lower than your current mortgage, and lower than you’d get with an equity loan.

With cash-out refinancing it’s important to remember your new mortgage will be higher than what you currently owe to make up for the amount of equity you turn into cash. Also, because it is a new mortgage, the loan process is longer, with more paperwork, and you can expect fees and closing costs. These expenses can often be rolled into the loan, allowing you to avoid paying this money up front. They could also be offset and recovered over the life of the loan, and by the savings that come with getting a lower interest rate. Like equity loans, the interest payments are usually tax deductible.*

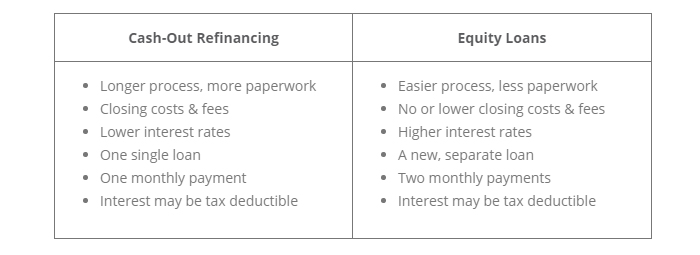

A Quick Comparison

What’s the right choice for you? That’s going to depend on your personal goals and financial needs. Equity loans require less effort to get, if you qualify. Cash-out refinancing is a longer, more complicated process, but may be more affordable over time, and refinancing can give you a better mortgage.

Talk to a PrimeLending mortgage expert at the McMullen Group who will help you compare your options to find the best solution that will enable you to renovate or repair your home.

*You should consult a tax advisor for more information about the deductibility of interest.

Prime Lending - By Michael Nevin